This is suitable for only blue-chip coins like Bitcoin, Ethereum, Binance coin to name a few. Rather, you can simply look at the fundamentals to plan your trading strategy. The advantages of long term trading are, you are immune to short term volatility, and you don’t need to follow the trading chart on a regular basis. This is recommended for those who believe particular cryptocurrencies like Bitcoin, Ethereum and others are going to the moon, and their investment will grow multiple folds. After buying crypto like Bitcoin, you simply hold it for a significant long time (years), and then sell it for a significant profit. Since you are new, you should know about the pop term of crypto called HODL. The long term trading could also be considered as investing in crypto. However, if you are coming from stock trading background, the typical stop loss logic will not apply to crypto trading, due to high volatility. Stop loss is going to be your best risk management strategy, to ensure you don’t end up losing a large portion. day trading), you will be winning some days, and you will be losing some days. A lot of people get into day trading, where they buy and sell crypto on the same day or a couple of days.ĭo note, in short-term trading (a.k.a. Short term trading is buying a cryptocurrency for a short time span, such as days, weeks or months for making a profit. The reason for the same is the wild volatility of crypto prices, which brings a great opportunity for someone to grow their crypto holdings with a strategy. I will be sharing a bit of pointer around this in the further section.Ī lot of people who got into cryptocurrency in the early days, now enjoy a mix of investing and trading. However, with time and practice, you can learn emotion and behavioral management, which is the key to ace in trading cryptocurrencies. The last two are most critical, and an important deciding factor. How long you have been following the crypto market.This decision depends upon a lot of factors such as: Investing?Īnother important thing to know at this stage is, do you want to be a crypto day trader or a silent crypto investor. What is the difference between Trading Vs. However, another league who is using c rypto to crypto trading, makes a significant profit over time.

At the time of the bull market, this is one of the best ways to increase your Bitcoin holding.Ī lot of beginners stick with Fiat to crypto trading, as it seems easy and familiar. This is also popularly known as altcoin trading. For example, you start with 0.1 BTC and trade it against other coins such as ETH, BNB to grow your BTC holding from 0.1. In this type, you use crypto as a base, and trade against other cryptocurrencies (altcoins) to grow the base coin.

This is by far the least understood, and most profitable form of crypto trading. Crypto to crypto trading: (Altcoin trading) In the further section of this guide, I have shared the example of fiat to crypto trading. The goal here is to grow your fiat money and keep booking the profit on a regular basis. In this type, fiat (USD, GBP, SGD, INR) is the base currency, and you trade it against cryptocurrencies like Bitcoin, Ethereum and others. There are two major types of crypto trading: 1. Keeping my philosophy behind, and let me help you get on-board into the world of crypto trading. It definitely comes with the risk of the unknown, but if one thing history has taught us, the wealth and power come to those who take bigger risks. It is an era of new beginning, and you are perhaps one of the first few in your social group to be thinking out of the box. Let me congratulate you if you have decided to start trading cryptocurrencies. And, make great wealth from crypto trading as well. Let’s learn the basics to ensure you don’t make the mistakes that others make. In this guide to trading crypto, I will help you learn the way of winners, and riches. Whereas losers are mostly, coming with gambling mentality, and they let emotions like greed, fear takes over their best self. The difference between winners and losers is, winners, know what they are doing, and they follow the wisdom of risk management. And, at the same time, there are beginner traders, who lose their lives long earnings in crypto trading.

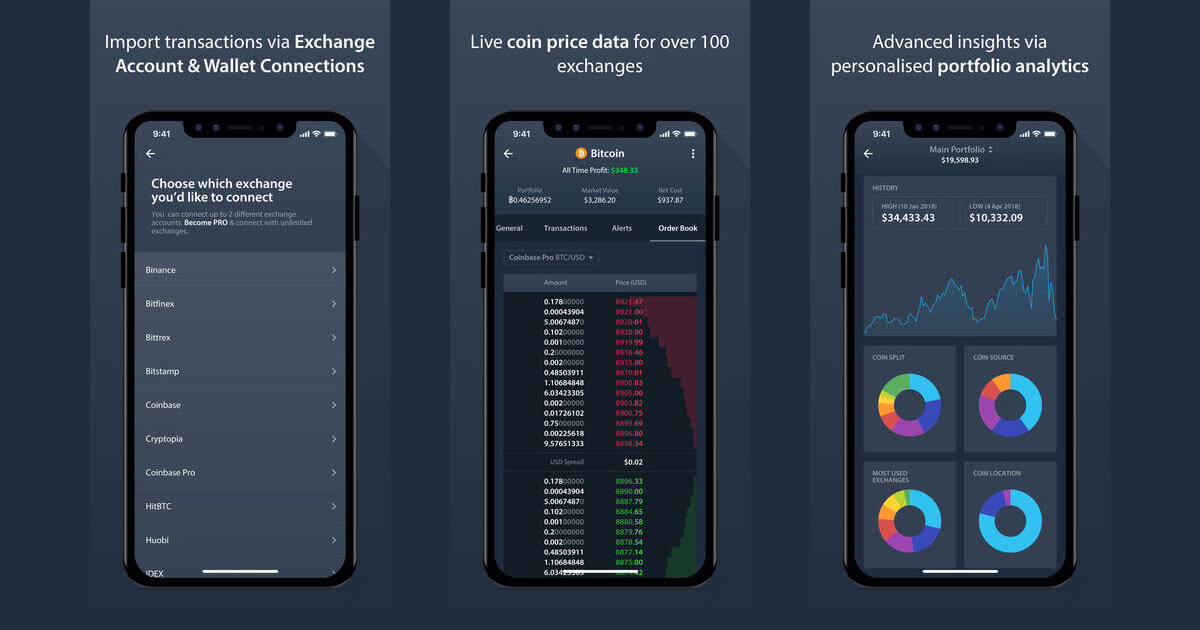

How to understand delta crypto tracker how to#

The post How To Start Trading Cryptocurrencies: Crypto Trading Guide for BeginnersĪnd, why not, as a lot of beginners who learned the art of crypto trading are becoming rich.

0 kommentar(er)

0 kommentar(er)